MSIG, one of Asia's leading general insurance brands, is a member of the MS&AD Insurance Group Holdings Inc. and a wholly owned subsidiary of Mitsui Sumitomo Insurance Co. Ltd., boasting a robust credit rating of A+ Stable. With over 40,000 employees and presence in 48 countries and regions globally, the Group is amongst the world’s top non-life insurance groups based on gross revenue.

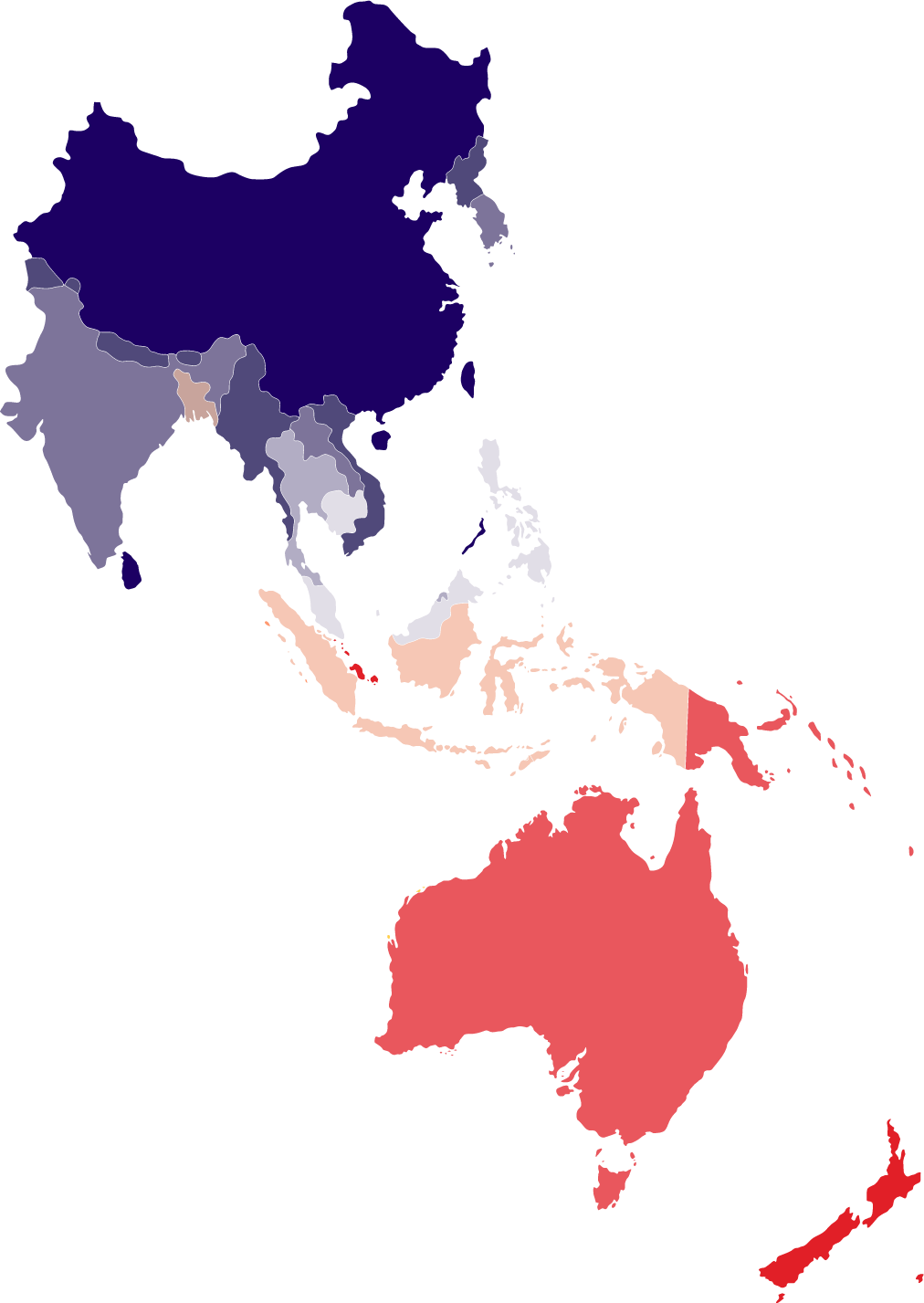

Within Asia, MSIG is represented in all ASEAN markets as well as in Australia, New Zealand, Hong Kong, China, Korea, India and Taiwan. It is the top non-life regional insurance provider in ASEAN based on gross written premiums.

MSIG’s expansive network also includes MS First Capital, headquartered in Singapore, and the Asia Pacific operations of MS Amlin. MS First Capital specialises in Corporate, Marine Hull, and unconventional risks, while MS Amlin delivers specialised insurance solutions in Property & Casualty, Marine & Aviation, and Reinsurance sectors.

With a dedicated commitment to the region and leveraging decades of expertise, MSIG harnesses its multi-channel distribution channels, partnerships and extensive geographical reach to offer a diverse array of insurance solutions across personal and commercial lines.

Within personal insurance, MSIG offers a suite of products including coverage for Travel, Home, Motor, Personal Accident, Health, and a host of other offerings crafted to meet diverse personal insurance needs.

For businesses and organisations, MSIG's commercial insurance portfolio encompasses an extensive array of products designed to mitigate risks and safeguard operations. These include Cargo, Marine, Aviation, Engineering, Employee Benefits & Compensation, Cyber and Financial Lines, and a range of other specialised offerings tailored to the unique needs of businesses across various industries.

At MSIG, we believe in staying true to our Japanese roots by upholding our long-standing values of customer service excellence, innovation and reliability. We take pride in our endeavors to elevate our product offerings, simplify the insurance procurement process, provide a seamless digital experience for our customers, and delivering peace of mind and financial security to individuals and businesses alike.

Mitsui Sumitomo Insurance Company, Limited (“Mitsui Sumitomo Insurance”), headquartered in Japan, was formed in October 2001 through a merger between the former Mitsui Marine & Fire Insurance Company, Limited (“Mitsui Marine”) and The Sumitomo Marine & Fire Insurance Company, Limited (“Sumitomo Marine”). Mitsui Marine and Sumitomo Marine were leading non-life insurance companies boasting long histories, having been established in 1918 and 1893, respectively.

MS&AD Insurance Group, Inc. (“MS&AD Insurance Group”) was formed in April 2010 from the business integration of Mitsui Sumitomo Insurance Group Holdings, Inc., Aioi Insurance Co., Ltd., and Nissay Dowa General Insurance Co., Ltd. It is amongst the world’s top 10 non-life insurance groups based on gross revenue, with A+ Stable credit rating and presence in 50 countries and regions globally. MS&AD Insurance Group is committed to achieving sustainable growth and to enhancing enterprise value, driven by five business domains: domestic (Japanese) non-life insurance, domestic (Japanese) life insurance, overseas business, financial services business and risk-related business.

We operate in a constantly evolving business environment where existing and new risks have grown and become more complex. At MSIG, we are determined to be part of the solution. That is why we operate and create resilient systems that swiftly respond to changes. Our medium-term management plan sums up our ambitions and targets for discovering opportunities for business growth and innovation that will continue to drive our sustainability agenda. Click to access the full MS&AD medium-term management plan (FY 2022 – 2025).

Our history

Mitsui Sumitomo Insurance was established in 2001 but our origins go back much further. "Mitsui” and “Sumitomo” were each formed more than 300 years ago and are still operating as business management groups with major influence in Japan and the rest of the world.

An enduring philosophy

Mitsui and Sumitomo achieved sustainable development over the long term by responsibly fulfilling their obligations to care for society and the environment, thus earning the trust of their many and varied stakeholders, including customers, employees and communities. This is the philosophy that still guides Mitsui Sumitomo Insurance today.

"Echigo-ya" Drapery Store in the Edo Era.

©公益財団法人三井文庫

Takatoshi Mitsui

©公益財団法人三井文庫

Echigoya - The name "Echigoya" was publicised by means of "flyers" and branded loan umbrellas. ©公益財団法人三井文庫

The Mitsui conglomerate began as a shop dealing in kimono fabrics called “Echigoya”. It was opened in 1673 by Takatoshi Mitsui, a merchant in Edo (now Tokyo).

With the aim of accommodating its customers’ needs, Echigoya introduced many innovative business practices. These included adopting over-the-counter-sales and the cash-and-carry system which were unheard of in Japan at the time. Furthermore, Mitsui used flyers and umbrellas printed with the shop's name to publicise his business.

Mitsui also focused on customer-centric business management and brand strategy, and sought to boost employee motivation and satisfaction through personality-oriented performance evaluations. These pioneering approaches laid the foundation for Mitsui’s subsequent success and prosperity.

Masatomo Sumitomo

© 住友史料館

Sumitomo prospered through diversification beyond copper into such commodities as yarns, fabrics, sugar and medicine.

© 住友史料館

A shaft at the Besshi copper mine

© 住友史料館

The history of Sumitomo began in the 17th century when Masatomo Sumitomo opened a book and medicine shop in Kyoto. Sumitomo gradually diversified into copper mining and trading, banking and heavy industry.

In 1690, Sumitomo discovered the Besshi Copper Mine in Ehime Prefecture which turned out to be one of the largest copper mines in the world. This major discovery contributed significantly to Japan’s economic development. However, the mining operations also impacted the environment. To help reduce this, Sumitomo planted more than one million trees and even relocated the copper refinery to an uninhabited island.

Sumitomo’s approach of contributing to the development of national and regional economies while also addressing environmental issues sowed the seeds for our corporate social responsibility initiatives of today.

Our network in Asia